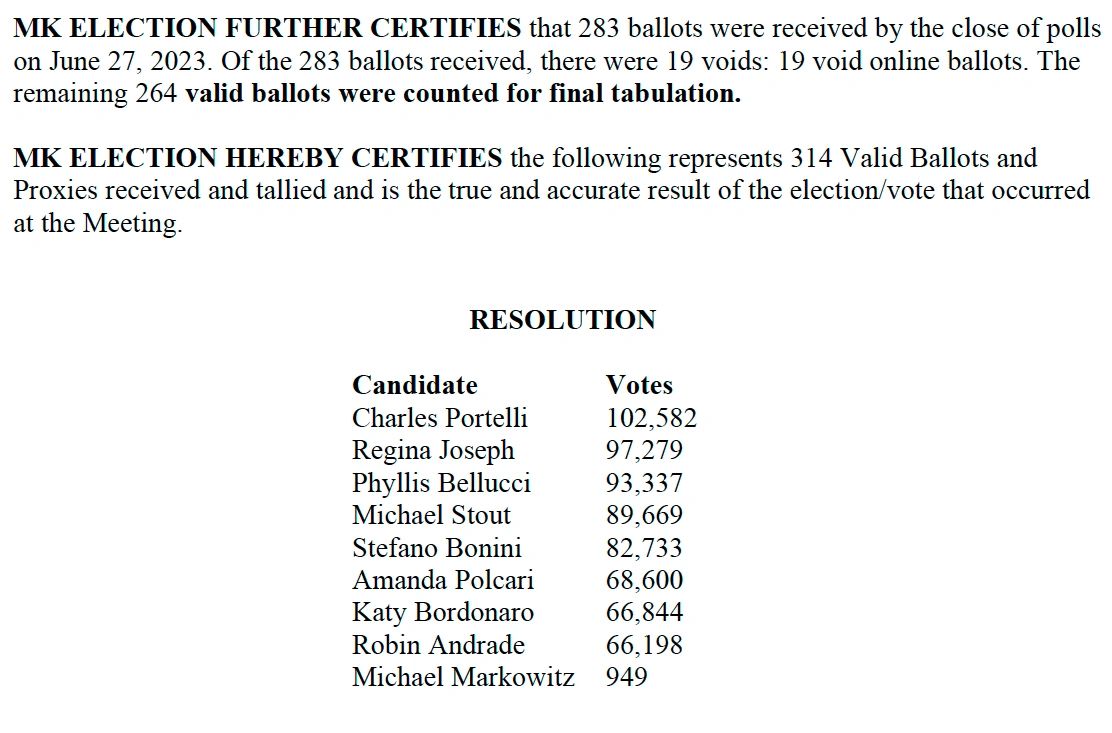

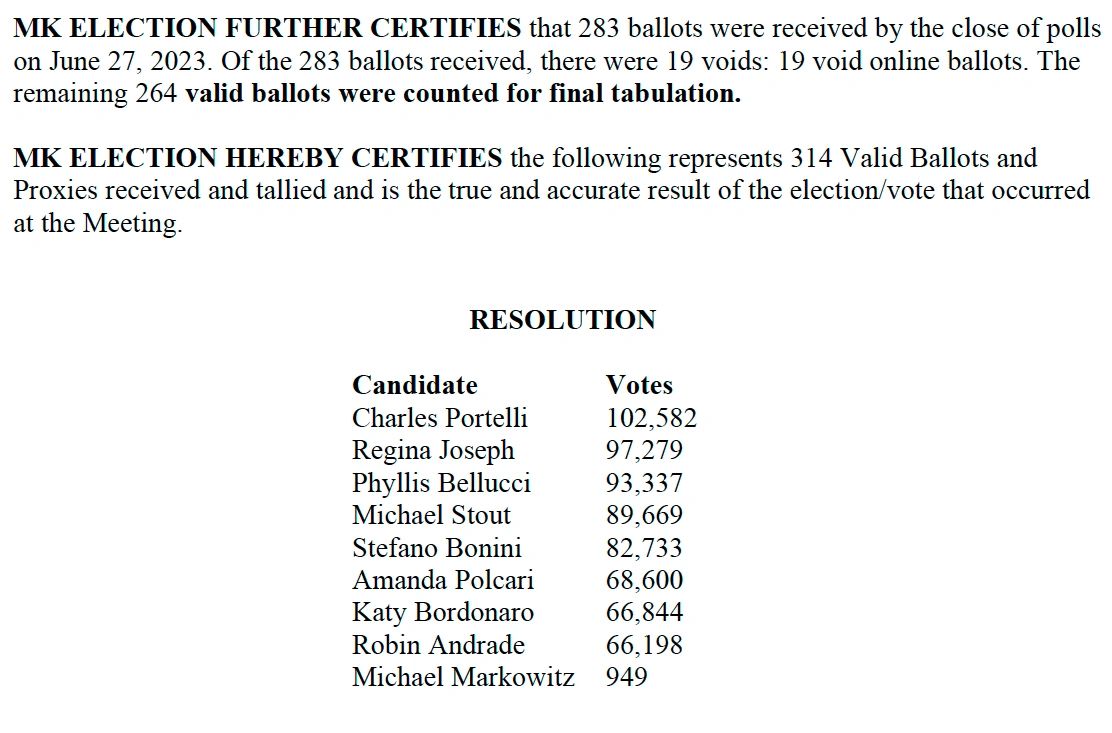

Congratulations Charlie, Regina, Phyllis and Michael !

Together, PRESERVEWVH is committed to:

As a member of the WVH Board Finance Committee, I write this note to address questions and comments posted in the Election 2023 Conversation concerning the tax abatement/assessment.

First, on May 19, 2023, the Board sent out a letter updating shareholders about the tax abatement/assessment issue. (Click the Related Web Link to access a copy of the letter.) The letter sets forth the Board's thinking behind its *unanimous vote* for taking an assessment against the abatement for Tax Year 2022/2023.

Second, as noted, the assessment was voted on and passed unanimously by the current Board (7 - 0) after considered deliberation, including counsel and guidance by the co-op's accountants and attorneys.

Notably, in addressing the question of why an assessment against the abatement is necessary given the garage sale in 2022, the Board informed Shareholders that "the proceeds of the garage sale were used to pay transaction costs, the HPD loan, as well as to pay down the 2018 NYCB Mortgage Loan to $10,000,000. This stabilized the co-op’s finances and prevented double-digit maintenance increases - (without the garage sale, the 2022 maintenance would have been raised by 17.5% instead of 3%). Going forward, the Board feels strongly that the co-op must exercise prudent fiscal management and we should not operate at a budget deficit."

As important, in reaching our unanimous vote, the Board took into account that from 2018 through 2022, shareholders had received more than $5 million in maintenance subsidies paid for, in substantial measure, by an additional $20 million loan, which had been taken out in 2018 by a prior board, and tacked onto our existing $40 million mortgage. The garage sale helped get us back on more solid footing, given these prior subsidies.

Third, taking an assessment against a co-op abatement is what most NYC co-ops do -- and generally, for good reason. This is a one-time, yearly occurrence that must be approved by the Board for the tax year in which a coop is taking an assessment against the abatement.

Finally, although WVH had not previously done this, the unanimous Board vote to do so this past year was undergirded by fiscally prudent reasoning (see May 19, 2023 letter). To be sure, and as noted in our letter, we determined that taking an assessment, given the co-op's recent fiscal choices, served everyone's best interests, particularly because it would advance the co-op's continued return to a more stabilized, healthier financial condition. And this benefits everyone.

(NB: I was unable simply to attach a copy of the letter to this BL note. If you have issues accessing the related web link, please send me an email. You should also be able to access the letter by checking your email; as far as I can tell, the letter was emailed on the morning of May 19, 2023.)

With fluctuating charges on our WVH electric bills, here's a few well written reports published in the April edition of West View News on Digital Smart Metering and RF Emissions.

From the New York Post and New York Times

The People vs. Big Development - The New York Times (pdf)

Download

Risk is the elephant in the room when it comes to private real estate offerings.

Its open discussion is often skirted at the outset of a proposed investment opportunity and, in some instances, vastly underestimated.

While avoiding investment risk is ideal, unless investors want to simply hold treasuries (which is generally referred to as the “risk free rate of return”), the reality is that risk is a natural part of any investment and commercial real estate is no exception.

— From "Top 10 Sources of Risk in Real Estate Investment Deals" (Article available for download in the "Real Estate Development Risks" section below)

Several shareholders are posting on Building Link, trying to defend the 2021 lawsuit that eventually disenfranchised 61 households, including ours, and seated 3 candidates who had actually lost the Board election by 25,000 votes.

First, the lawsuit defenders concede unanimously that there was no actual fraud or vote stealing during or after the vote. As one of the shareholders who helped bring the suit posted: "True, no fraud was alleged." Another shareholder, who had at first equated what happened here with Trump's efforts to stuff ballot boxes in Georgia, amended his Building Link post to withdraw the allegation. He never should have said it in the first place.

Instead, the lawsuit's defenders argue that the law had to be observed, no matter the consequences. We disagreed with their legal interpretation, and we're thankful the board back then defended our votes in court. But once the judge decided, we accepted the verdict, and tried to look ahead to continue strengthening our coop's financial status.

Until now. The issue revived after supporters of one slate of candidates in the current election, (which includes 2 people who lost in 2021 but were put there by the judge), started attacking the board back then for resisting the lawsuit.

There's an old saying that goes like this: "The letter of the law killeth, but the spirit of the law giveth life." As we've seen, there was not the slightest hint of actual fraud. So was it wise to try and use a legal technicality to erase 90,000 share/votes, and put people on the Board who had lost at the ballot box? Did the lawsuit contribute to the spirit of cooperation that we need here as we continue to move forward into what can be a challenging future? Why didn't the small group who sued us pause, and at least consider the petition for a quick revote, which a huge number of us signed in the days right after the 2021 election?

Do the people who brought the lawsuit have any regrets, even though it did "win" in narrowly legal terms? Was it really worth it to divide our community further?

Fact-based articles from reputable sources on Co-Op governance, rights and legal issues found below

promoting preservewvh.org as the go-to site for fact-based user-friendly information

Connect to our Facebook page: https://www.facebook.com/groups/661272257565057/about/